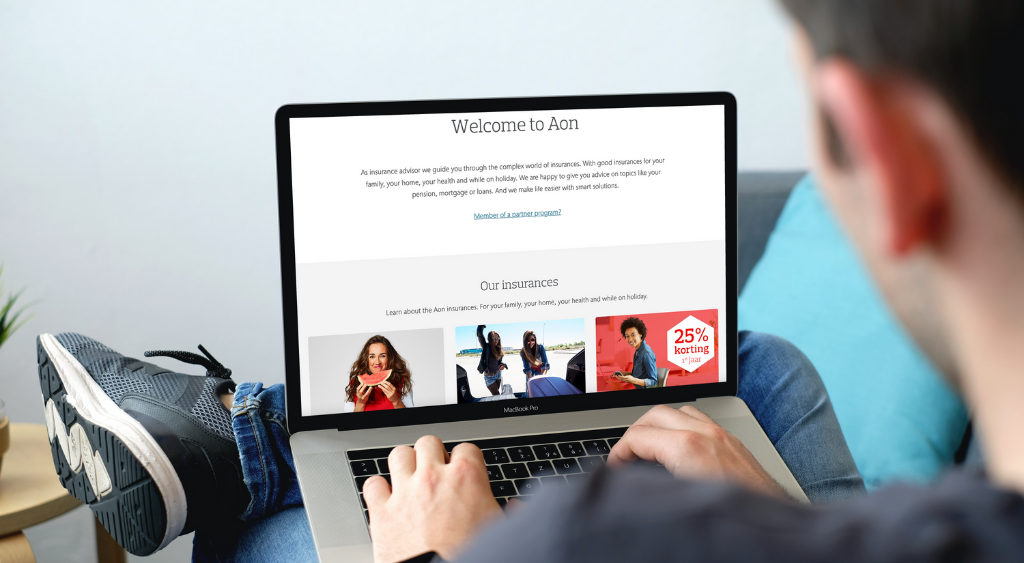

AON: Full Insurance Platform

We were introduced to the project in 2013 when AON needed a partner to build a functional, scalable, and robust customer-facing insurance platform. The scope was to develop both front & back-end systems.

Convenient Insurance Platform for Customers

AON Netherlands is one of the largest insurance brokers in the Netherlands. Annually they insure over 300,000 individuals with custom insurance packages. They cover everything from fire damage to car insurance, even legal insurance.

When you are a market leader like AON – you are constantly under attack from competitors who want to take your top spot. To remain on top you need to be bold, innovative and build solid solutions. That was the case in 2013 when AON approached us to help them define and build their Insurance Online Platform, or IOP.

While the eventual outcome is a solid software solution for a top leader in the Dutch insurance market – the effort behind the scenes are maybe more interesting. The architecture was an interesting challenge (great job of our .NET team), but there were a few more obstacles along the way. That is why we are so proud that Yameo was invited to help such a top leader with this challenging and innovative project.

AON’s Recognition of the Market

As one of the largest insurance brokers in the Netherlands – AON needed a web platform able to handle hundreds of thousands of insurance requests whilst offering seamless and reliable service to their customers. The insurance market being one of the most competitive environments to operate in – AON recognised they needed a top solution. Considering that a study at the time revealed:

- 58% of customers use mobile devices to handle their insurance requests, up from 42% the year before

- 66% of customers are only interested in quick service

- 75% of competitors had stated modernisation & innovation was a top priority for that year

AON’s Challenges

A large enterprise as AON has an abundance of skills and expertise, including a large IT department. However, where they needed support was in defining their idea into a definitive solution.

- Connect with multiple suppliers

- Authenticate the user using National ID Verification Platform – DigiD

- Create an advanced business rules engine

- Enable policy price calculation for end customers

- Be easy to use and be accessible on all devices

We had seen these challenges before having worked on previous front- and backend systems. To start we first helped AON map out their advanced business rules engine, so we could make a clear flow of actions and reactions and tested this extensively. Since this element had the most impact on user experience as well as bottom-line performance for AON it was an important starting point.

Via in-depth workshops we pinpointed the areas where AON had the relevant knowledge and where they lacked skills. To make it easy we focused on the necessary technical requirements.

The Goal was set, the path to get there was clear

AON set a clear goal: design a solid web platform able to handle claims requests from customers whilst also allowing an interactive and real-time experience to calculating, comparing and choosing insurance packages. The target: satisfy a growing tech savvy customer base with a convenient insurance web platform.

Major requirements of the project

Integrate with AON’s Oracle Backend

To get the best value we proposed an integration with their current backend, saving them costs and maximising the value of their current IT infrastructure.

Develop an Advanced business rules engine

With business rule engines based on the legal requirements, company policies and multiple sources this is where we excelled. Having done previous projects with Dutch insurers we were well rehearsed with Dutch and EU regulations which strongly influenced the design and approach to developing an advanced business rules engine.

Create a PDF document creation & processing functionality

Via Agile methodology we built, tested and demonstrated the functionality to AON’s team of Project Managers.

Integrate with National Identification Platform – DigiD

We know this is a key component of the project and so we used our Dutch resources to work with the Dutch national identification platform to successfully integrate with the IOP solution.

Insurance price calculation Feature

A key feature for successful user experiences was the price calculator. Therefore we recommended to build and test the feature with real-world persons for relevant feedback.

Policy and declaration view

A clear user interface was important here – we developed with our in-house UX/UI developers a modern and reactive interface.

Call Centre application with Direct Access to customer’s account

Another big hurdle was the Call Centre Application with Direct Access. This job of the project required close communication and teamwork with AON’s team and together we made a successful solution with Direct Access in place.

How Yameo helped AON achieve their goal!

To make the project work, AON asked Yameo for help. Our team worked with AON for about 2 weeks doing research, review, and a 5-day workshop with the client. We analysed the customer’s ideal journey and dissected it to see all the relevant parts. This eventually formed the basis for the IOP solution.

During the Discovery workshops, a joint team from AON and Yameo:

- Identified all the stakeholders and potential blockers they may face

- Defined the whole process of all the supported use cases – insurance claims; package selection; invoicing etc.

- How to liaise with different units and engage all stakeholders in the process

- How to work in an agile way, reporting, project sprints, and MVPs

- How to communicate and make decisions within fully remote teams.

“This project really demanded a deep look into the customers ideal journey as well as AON’s internal systems. It was fascinating analysing how to combine both elements. Only then did we start with actual development – with an end result of a truly Custom Insurance Platform”

Jakub Czechowski, Project Manager Yameo

The Solution: Insurance Platform

An advanced platform for offering insurance functionalities for AON underwriting customers. It requires connectivity in real-time with 10+ different suppliers in order to authorise the user, send data, nest the platform in a separated frontend layer. We are also serving infrastructure with monitoring and backup policies compliant with ISO and ISAE certifications.

The Results

We want to work with you!

Let us prove that we are the best choice you can have. Just one call with us might solve many of your IT problems and you will gain a Trusted Tech Partner for years, not months.

Get in touch